- Realme is now ahead of stablemate and former parent Oppo in the Indian market.

- The former Oppo subsidiary shipped 4.9 million units in Q2 2021 compared to Oppo’s 3.8 million.

Realme was originally an Oppo-owned brand before announcing it was an independent company and then recently drawing closer to its stablemates. Regardless of the ties to Oppo and the BBK conglomerate, the firm has experienced major growth in recent years, especially in India.

In fact, tracking firm Canalys has just posted its Q2 2021 report for India, revealing that Realme now has more market share than big brother Oppo in the region. More specifically, Realme shipped 4.9 million units in the quarter, while Oppo mustered 3.8 million units. This puts the newer BBK brand in fourth place compared to Oppo’s fifth position.

This suggests that Realme’s value-focused strategy is reaping major dividends in the price-sensitive Indian market. The company has launched bang for buck devices like the Realme 7 and 8 series, the Narzo range, the C-series, and the X range.

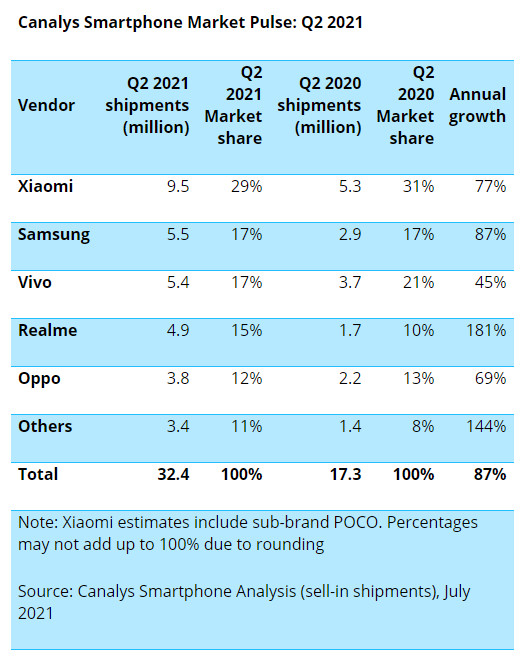

Looking at the Indian market as a whole for the quarter, Canalys noted that smartphone shipments were up 87% year-on-year but down 13% quarter-on-quarter. The former figure is due to a two-month shutdown a year ago, while the quarterly decline was due to the second wave of COVID-19 hitting the region.

Xiaomi maintained the top spot with 9.5 million devices shipped (29% market share), followed by Samsung in a distant second place with 5.5 million phones shipped (17%). Vivo was just a hair behind Samsung with 5.4 million devices shipped (17%), rounding out the podium. Realme and Oppo completed the top five.

More reading: The best phones under Rs 30,000 in India

Canalys research analyst Jash Shah explained that companies making a splash in the online space were the ones that pulled big numbers in this quarter.

“Xiaomi, despite its overall sequential decline, actually grew its online business, primarily thanks to the Redmi Note 10 series,” Shah explained. “Realme also saw online momentum, particularly with its Narzo 30 series, as it used price cuts during ‘brand-focused days’ to overtake Oppo.”