Cryptocurrencies such as Bitcoin have exploded in terms of valuation and popularity of late. Since the market’s crossover to the mainstream in the early-2010s, over a hundred million cryptocurrency wallets have been created. In fact, the industry has now reached a similar adoption threshold to the internet back in 1997. If you’re looking to hop on the bandwagon today, consider yourself lucky — cryptocurrency investing has probably never been easier.

Just as with any other form of investment though, paying attention to the right details can help you make the most of your money. To that end, let’s explore three popular approaches to buying digital currencies and how they differ from one another. Along the way, we’ll also briefly discuss cryptocurrency taxation and risk management — key considerations for any investor just starting out.

Read more: Bitcoin explained — The controversial digital currency worth billions

Approach 1: Cryptocurrency exchanges

Exchanges are the cryptocurrency equivalent to stock market brokers such as TD Ameritrade and Charles Schwab.

These platforms use internal order books, which automatically match buyers and sellers of a particular cryptocurrency. This system insulates you from so-called counterparty risk, since you don’t need to trust the person on the other side of the trade. In other words, the cryptocurrency exchange acts as the intermediary that guarantees smooth trade execution.

Getting started is pretty straightforward: simply sign up for an account with the exchange of your choice. Some popular options include Coinbase, Kraken, Gemini, and Binance. Alternatively, check out the exhaustive list maintained by CoinGecko.

Pretty much all legitimate exchanges require you to verify your identity while signing up. This is because governments around the world mandate that cryptocurrency exchanges comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

While this may sound complicated, the good news is that it is only a one-time process. The exchange you sign up with will likely just ask you to upload scans of your driving license, national tax document, or similar identity proof, depending on your region. However, keep in mind that the review process may take a while to complete, so you will not be able to buy cryptocurrencies immediately.

Read more:

Once your account has been verified, you will have full and unfettered access to the exchange’s trading interface. From this point on, you can deposit funds into your account and start cryptocurrency investing.

It’s worth noting that cryptocurrency exchanges will typically not let you use a debit or credit card to deposit funds and purchase tokens. While this was an option several years ago, banks have since restricted their use for such purchases, citing the cryptocurrency market’s volatility.

To that end, don’t be surprised if the only way to deposit funds is via a direct wire transfer. Given the slow nature of inter-bank financial transactions, deposits may take several hours or even days, so plan ahead of time.

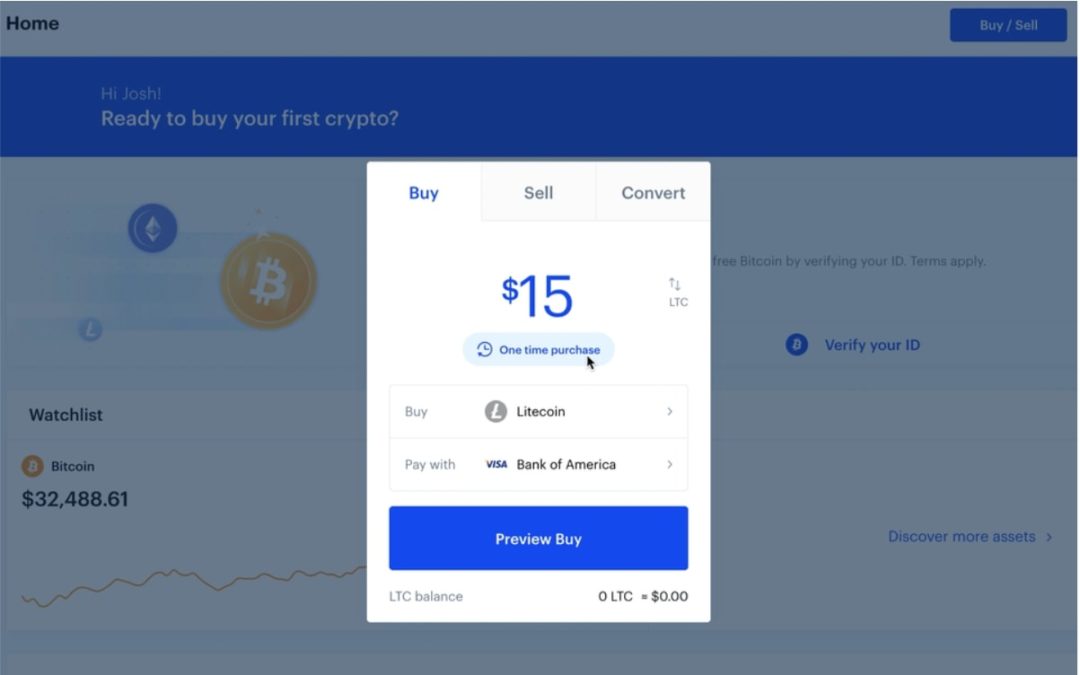

Once the deposited funds reflect in your account, you are ready to place an order. Most exchanges offer simplified and advanced interfaces. If you’re not comfortable with the intricacies of trading yet, simply stick with the former. On Coinbase, for instance, all you have to do is input an amount and the platform will take care of the rest.

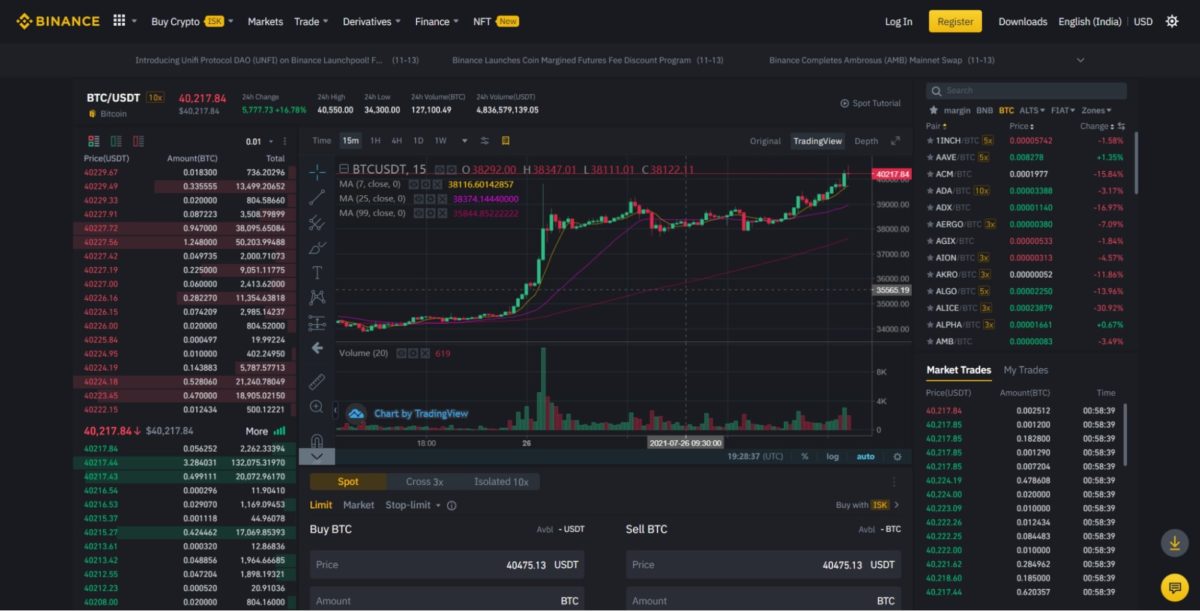

You can also optionally navigate around your exchange’s advanced interface to familiarize yourself with it. The data provided here is invaluable as it offers considerable insight into market trends and recent trades. Eventually, you may even be able to predict the market’s future performance using these tools. These platforms also tend to offer additional perks. Coinbase Pro, for instance, has a lower fee structure than regular Coinbase. You’ll find that other exchanges have similar, if not identical, systems as well.

Selecting a cryptocurrency exchange

In the early days of the cryptocurrency market, it was common for everyone to use just one or two exchanges. Of late, though, hundreds of trading platforms have emerged — each with its own strengths, niches, and compromises.

Keeping all of this in mind, it’s vital that you pick an exchange that not only meets your needs, but is also secure and trustworthy. Here are a few criteria to consider before you settle on a platform:

- Security: The most important consideration when picking a cryptocurrency exchange is its track record in terms of asset and user security. Over the years, trading platforms have cumulatively lost millions of dollars worth of cryptocurrency to hacks and security breaches. In the absence of a trustworthy exchange, consider using a peer-to-peer exchange instead. We’ll discuss these platforms in a later section.

- Regulatory oversight: Unlike stock exchanges, cryptocurrency trading platforms can be incorporated anywhere in the world. It is also pretty common for a single platform to serve customers from different countries, if not continents. While these platforms will often boast the highest trading volumes, consider picking a local exchange instead. Platforms such as Coinbase and Gemini that are based in the US, for example, comply with stricter regulations and are subject to a higher degree of accountability.

- Fee structure: Certain exchanges lure users in with the promise of low trading fees. However, there are plenty of other potential charges and fees you should check for as well. Binance, for one, boasts exceptionally low trading fees. Look closer though and you’ll find that withdrawing your cryptocurrency to an external wallet will likely cost significantly more than on a competitor’s platform. A Bitcoin withdrawal from Binance, as an example, would cost you a flat 0.00057 BTC. That is quite a bit more than the average fee paid on the Bitcoin blockchain, barring some periods of abnormality.

Approach 2: Peer-to-peer trading platforms

If centralized cryptocurrency exchanges don’t appeal to you for some reason, consider peer-to-peer (P2P) trading platforms for cryptocurrency investing.

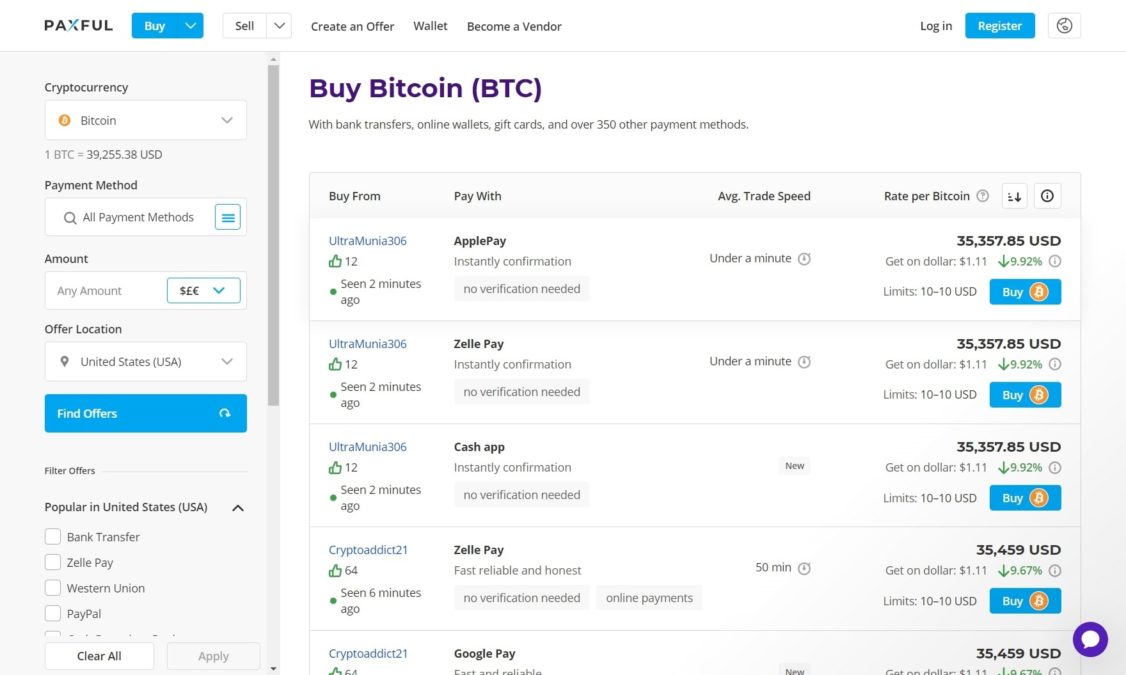

Peer-to-peer trading platforms match buyers with sellers and vice-versa. Since these trades take place directly between individuals, either party can set their own prices and terms. Possible payment methods include online bank transfers, cash, gift cards, and almost anything else with value.

LocalBitcoins and Paxful are the two largest brands in this space and have plenty of liquidity in most countries. In fact, they have lowered the bar for cryptocurrency adoption to a considerable degree in regions with less stable economies. Users from Venezuela and Zimbabwe, for instance, almost exclusively rely on P2P platforms.

While P2P trades with strangers may seem risky, the aforementioned platforms do attempt to alleviate the obvious issues to some extent. Specifically, the cryptocurrency being traded is held in escrow until the barter is completed. In case any disputes occur, a human will manually review both parties’ claims and release the escrow one way or another. This is why it is considered best practice to use digital payment methods. During a dispute, these can be proven beyond a reasonable doubt.

Both Paxful and LocalBitcoins also offer feedback and reputation systems to ensure traders comply with the platform’s rules. A long-time trader with a near-100% feedback score, for instance, is pretty trustworthy. If you’re just getting started on these platforms, consider trading exclusively with established traders — even if that means paying a small premium for the privilege.

Peer-to-peer trading may seem incredibly tedious, especially if you need to queue multiple trades for larger amounts. In practice, however, P2P trades can be faster from end to end than using a cryptocurrency exchange since your funds don’t go through a middleman. These platforms also charge lower fees since they don’t have to offer high-frequency order books and other advanced features.

Approach 3: Traditional brokers or finance apps

If you already have an account with PayPal, Cash App, or Robinhood, buying cryptocurrency through one of them may seem like the most convenient option. However, you may want to do some research before pulling the trigger, as they often impose unreasonable limitations, such as preventing you from withdrawing your cryptocurrency to an external wallet.

Prices on these platforms may differ from the prevailing exchange rate. That means you may end up getting less crypto for your money as compared to either of the previous options. Furthermore, most apps only offer a limited number of cryptocurrencies. If you foresee yourself investing in a relatively obscure token, these platforms won’t be useful for long. For context, exchanges such as Binance offer hundreds of trading pairs — including crypto to crypto ones.

Consequently, these traditional platforms should only be used as a last resort. While the convenience of cryptocurrency investing through an existing app on your smartphone is undeniable, you’ll likely save money by signing up for an exchange account in the long term.

How much money should you invest in cryptocurrency?

There are two fundamental ideologies to investing: active and passive. The former involves paying constant attention to your portfolio and its allocation. The latter, meanwhile, is a mostly hands-off approach.

If you’re just starting out with cryptocurrency investing, it is worth pointing out that the market is extremely volatile. Digital currencies routinely gain and lose 10-20% of their value in a single day, whereas the stock market may only move a couple of percentage points over the same time period. Even established cryptocurrencies like Bitcoin exhibit this kind of volatility from time to time. This is why short-term trading is almost always a bad idea for inexperienced investors.

Maintain a longer time horizon, however, and the appeal of cryptocurrency investing suddenly starts to become apparent once again.

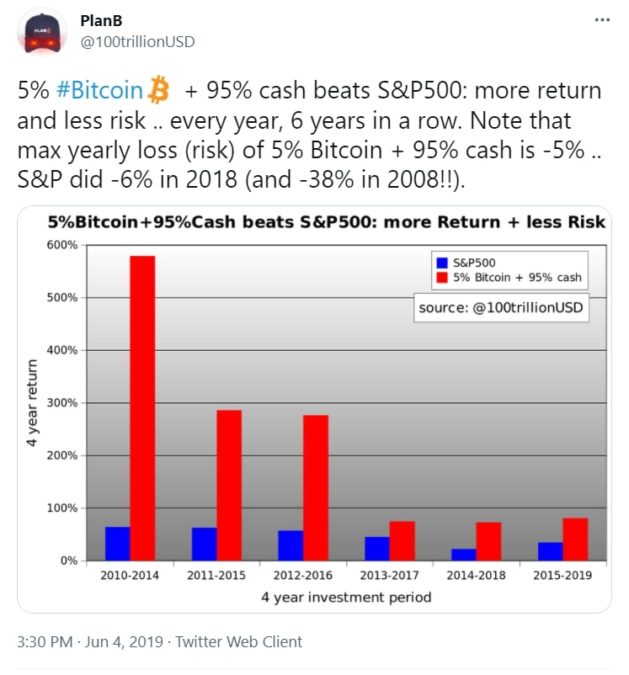

As the above tweet indicates, a relatively tiny Bitcoin allocation manages to outperform the S&P 500 index over a four-year investment period. While past performance is not indicative of future gains, the above statistic should influence your investment’s time horizon. It also explains why some experts are of the opinion that investors should maintain some exposure to the cryptocurrency market — even if it’s only limited to 1% for now.

Finally, don’t forget the common cryptocurrency adage that you should only invest what you’re willing to lose. The vast majority of small-cap tokens never see the light of day, so either stick to reputed brands like Bitcoin and Ethereum or embrace the heightened risk that comes with investing in new ventures.

Cryptocurrency investing: Don’t forget your taxes!

Say you invested in a cryptocurrency, made a decent return on the investment, and are now considering liquidating it all to lock in your profits. Depending on where you live, your local tax authority may require these transactions to be disclosed in your tax return. This is because most countries impose some form of capital gains tax on cryptocurrency profits.

In the vast majority of cases, you will only owe taxes on the profits earned. You can use the following formula as a rule of thumb:

Taxable gains = Final sale amount - Purchase amount - Fees or brokerage paid

Once you’ve ascertained your net gain, the next step is to calculate how much tax you owe. In the US, the capital gains tax rate varies by total income — but is limited to a maximum of 20%, according to the Internal Revenue Service’s website.

Some other countries, such as the UK, offer a tax-free allowance every year, after which you pay a rate based on your income level. Finally, countries like Germany have a zero percent capital gain tax rate on the sale of cryptocurrencies, provided you hold onto your investment for at least one year.

Another thing to keep in mind is that tax rates may vary based on how long you held the asset before selling it. In most countries, capital gains are classified as either short-term or long-term. However, the distinction between the two varies by region, so consult your tax agency’s documentation to know exactly what the duration for each is. Typically, short-term gains are assessed alongside your income, so your tax liability may be higher than an equivalent long-term profit.

The good news, however, is that you can offset your tax liability with any losses you incur during your trades. In the US, the entire loss can be deducted against your capital gains — provided you limit your deductions to $3,000 per year. Put simply, if you lost $9,000 this year, it would take the next three tax years to offset it.

Simplify your tax tracking

If keeping track of your total tax liability seems like too much effort, it may be worth knowing that most cryptocurrency exchanges have built-in tools to assist with this. Coinbase, for instance, offers US-specific tax forms for some of its products. Third-party software tools such as Koinly are even more feature-rich and offer country-specific advice. However, they cannot replace proper professionals in this domain.

Major exchanges also offer the option to download a yearly account statement. This negates the need to keep manual records, but they are only useful if you stick to known exchanges. If you’re a bit more adventurous and use decentralized exchanges such as Uniswap, you will have to draw up your own records.

On that note, keep in mind that some tax jurisdictions consider crypto to crypto transactions as taxable events. This means that converting your Bitcoin holdings to Ethereum, for instance, is no different than selling that Bitcoin for US dollars or any other fiat currency.

Read more: What is Ethereum? Here’s everything you need to know.

Cryptocurrency blockchains are inherently transparent and leave a digital trail for enforcement authorities to follow. If you fail to disclose these transactions and are later subjected to an audit, the penalties will likely vastly outweigh any gains. To that end, it’s a good idea to document everything to the best of your abilities.

Cryptocurrency blockchains are inherently transparent and leave a digital trail for authorities to follow.

To summarize:

- Any profits you make trading cryptocurrency may be subject to capital gains taxes.

- Any losses you incur may be offset in subsequent years’ tax returns.

- Crypto to crypto trades are sometimes taxable events as well.

- Check your local tax agency’s website for crypto-specific guidance

- Consider consulting a tax professional to ensure compliance.

Beyond the investment: Next steps

As mentioned previously, cryptocurrency trading platforms are a common and lucrative target for hackers. Even small platforms these days hold millions of dollars worth of user-owned cryptocurrency. Unlike banks or financial institutions, however, your funds are not insured by a central bank. This means that an ill-timed security breach could wipe out your entire portfolio and leave you with no recourse.

High-profile hacks and security breaches were relatively common between 2013 and 2019. At one point, North Korea supposedly even hired hackers to steal cryptocurrency worth $112 million from smaller exchanges based in South-East Asia. The situation worsened to the point that Kraken’s co-founder and CEO advised investors to withdraw their crypto from exchanges.

While some big-name cryptocurrency exchanges are indeed trustworthy, they can still have a single point of failure. For proof of this fact, look no further than the mysterious death of QuadrigaCX’s founder and CEO, Gerald Cotten, in 2019.

According to the Canadian company’s bankruptcy filings, nobody except the founder had access to the exchange’s wallets. When news of Cotten’s death broke, over 115,000 customers lost $190 million worth of cryptocurrency in the blink of an eye. QuadrigaCX wasn’t a small exchange either. It was Canada’s largest cryptocurrency trading platform until its demise in 2019.

So what can you do to safeguard your cryptocurrency investments? Consider withdrawing your digital assets to a software or hardware wallet on a device that you have full control over. For more on this subject, consider reading our in-depth guide on cryptocurrency wallets.